Welcome!

Welcome!

I am a professor of Economics at the University of Hohenheim, where I hold the Chair of Public Economics. I am also an affiliated researcher at the Chr. Michelsen Institute Bergen as well as a CEPR affiliate and a CESifo fellow.

My research investigates the economic impact of government policy.

The first strand of my research studies tax enforcement and its distributional effects.

The second strand of my research focuses on the economics of the public administration. I strive to understand how to build administrative capacity where it is lacking. Moreover, I research the economic effects of administrative capacity.

In the third strand of research, I investigate the long-term effects of public policy with a focus on declining regions.

Work in Progress

Building Capacity in the Public Administration: Evidence from German Reunification

with A. Gumpert.

What is Fair? Experimental Evidence on Fair Equality vs Fair Inequality

with I. H. Sjursen & J. Vietz. CESifo Discussion Paper 11289, CEPR Working Paper 19472. ![]()

Successful Advances in Fiscal ARchItecture (SAFARI): Evidence from a new tax in Zanzibar

with O.-H. Fjeldstad, I. H. Sjursen, V. Somville, A. Dautheville.

Reducing Survivor Pension to Promote More Equal Labor Market Attachment of Women: Evidence from Sweden

with J. Kochems, M. Nybom, S. Siegloch.

Selected Publications

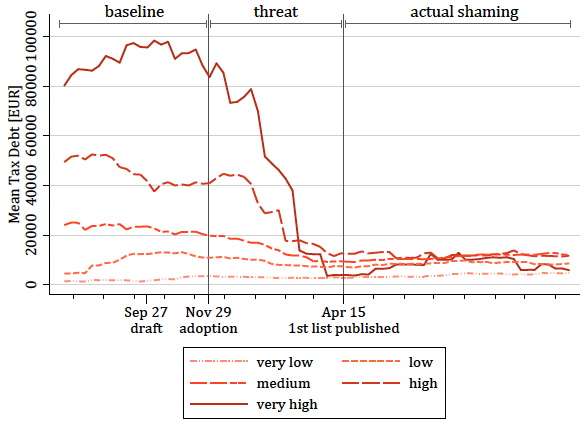

Shaming for Tax Enforcement

with L. Treber, Management Science, 2022, 68(11), 7793-8514.

Water the Flowers You Want to Grow: Evidence on Private Recognition and Charity Loyalty

with B. Bittschi & J. Rincke, European Economic Review, 131, 103624, 2021.

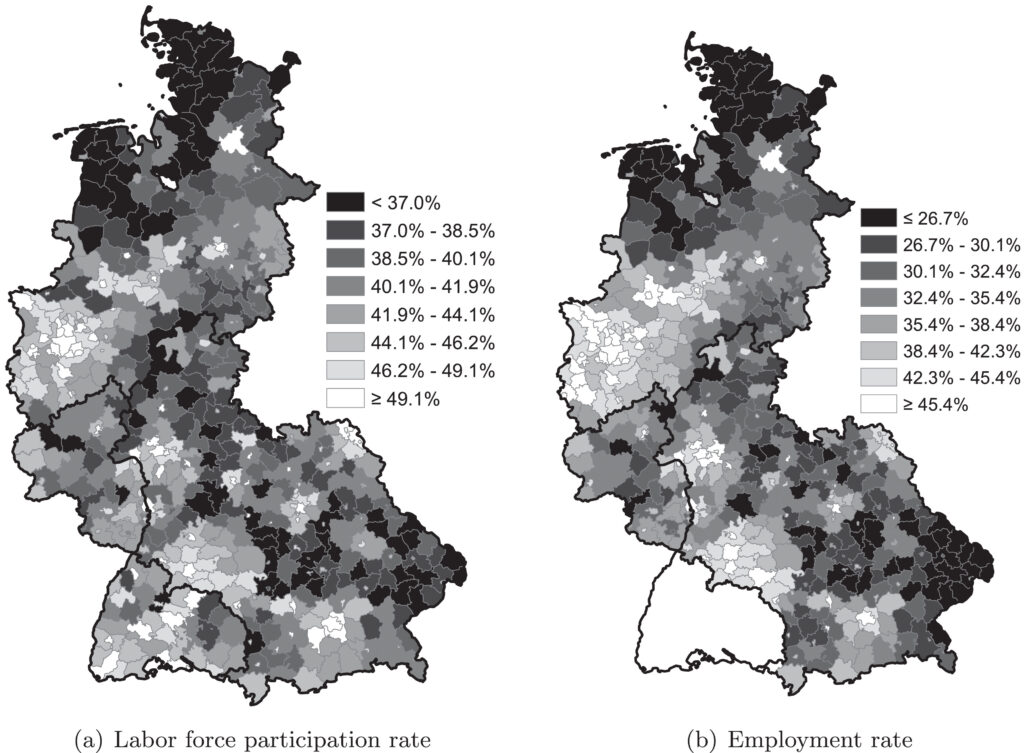

Settlement location shapes the integration of forced migrants: Evidence from post-war Germany

with S. Braun, Explorations in Economic History, 77, 101330, 2020.

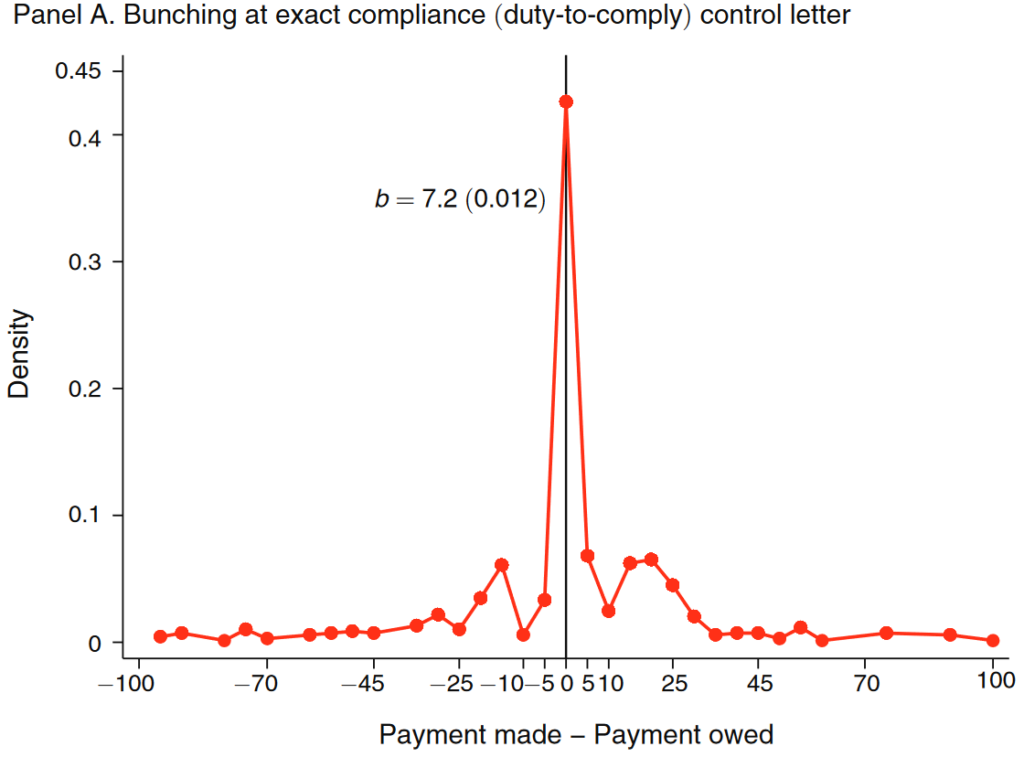

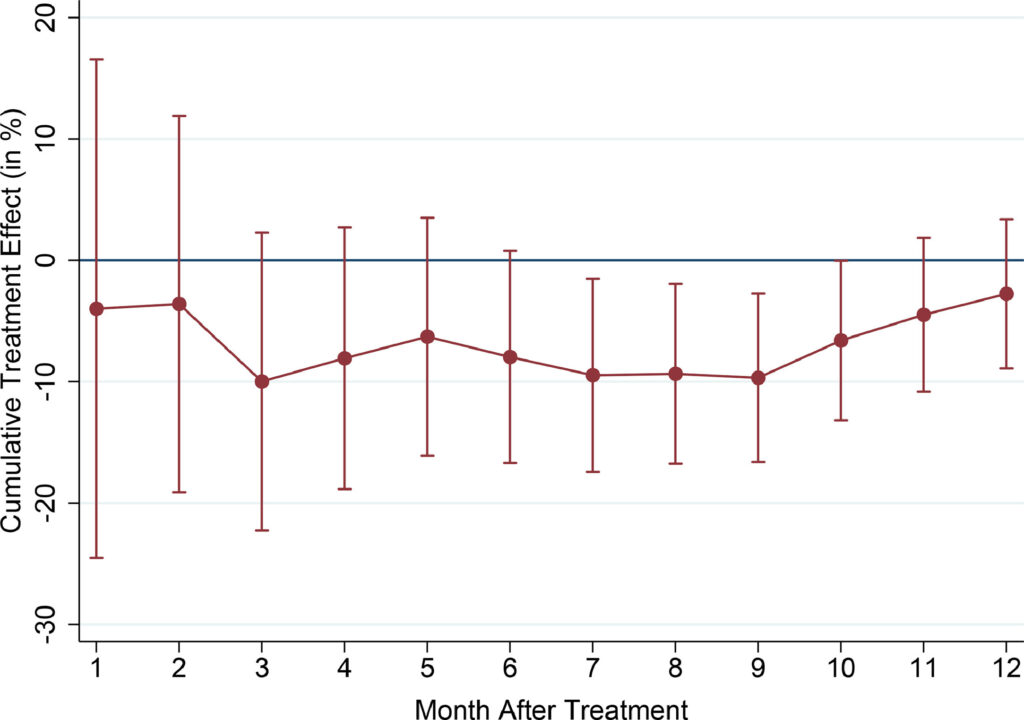

Extrinsic and Intrinsic Motivations for Tax Compliance: Evidence from a Field Experiment in Germany

with H. Kleven, I. Rasul and J. Rincke, American Economic Journal: Economic Policy 8(3), 203–232, 2016.